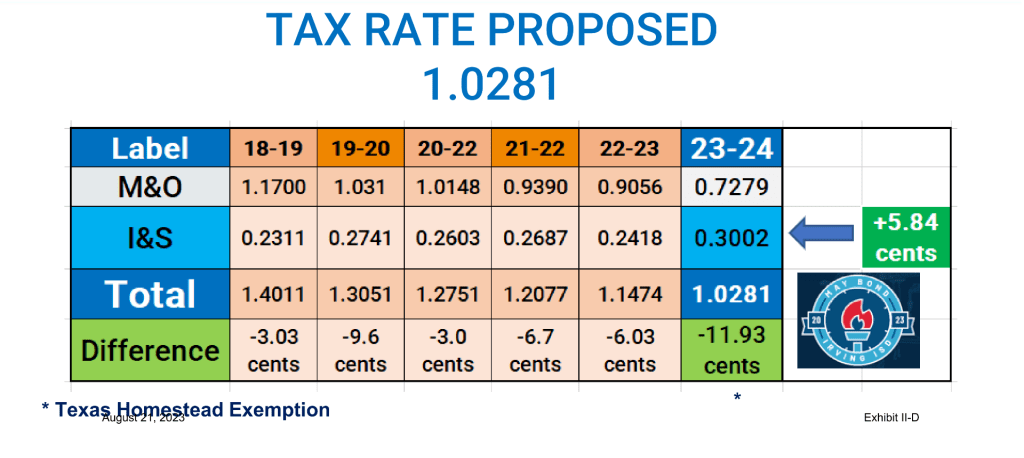

Irving ISD announced the tax rate for the 2023 tax year at the most recent School Board Meeting on Monday, August 21. The new total tax rate of 1.0281 was voted on and approved unanimously by the Irving ISD Board of Trustees. This marks a decrease of 11.93 cents from last year’s total tax rate of 1.1474. The average Irving homeowner can expect to see a reduction of around $600 in their tax amount.

“I am so proud of our finance team and committees,” says Irving ISD Superintendent Magda Hernandez. “Thanks to their hard work, our district is able to offer a lowered tax rate to our Irving taxpayers.”

This new tax rate reflects the passing of the May 2023 Bond. Although the Interest & Sinking (I&S) tax rate increased by 5.84 cents from 0.2418 to 0.3002, the Maintenance & Operations (M&O) tax rate decreased by 17.777 cents from 0.9056 to 0.7279, ultimately resulting in a decrease in the overall tax rate.

“For months, we have been meeting two to three times a month, monitoring the situation and expecting a five-cent reduction,” says Fernando Natividad, Chief Financial Officer for Irving ISD. “However, because of the new Texas Homestead Exemption law, we now have additional cents to work with. So, the total ends up being a decrease of almost 12 cents difference from last year.”

Click here to learn more about the Homestead Exemption and the application process.