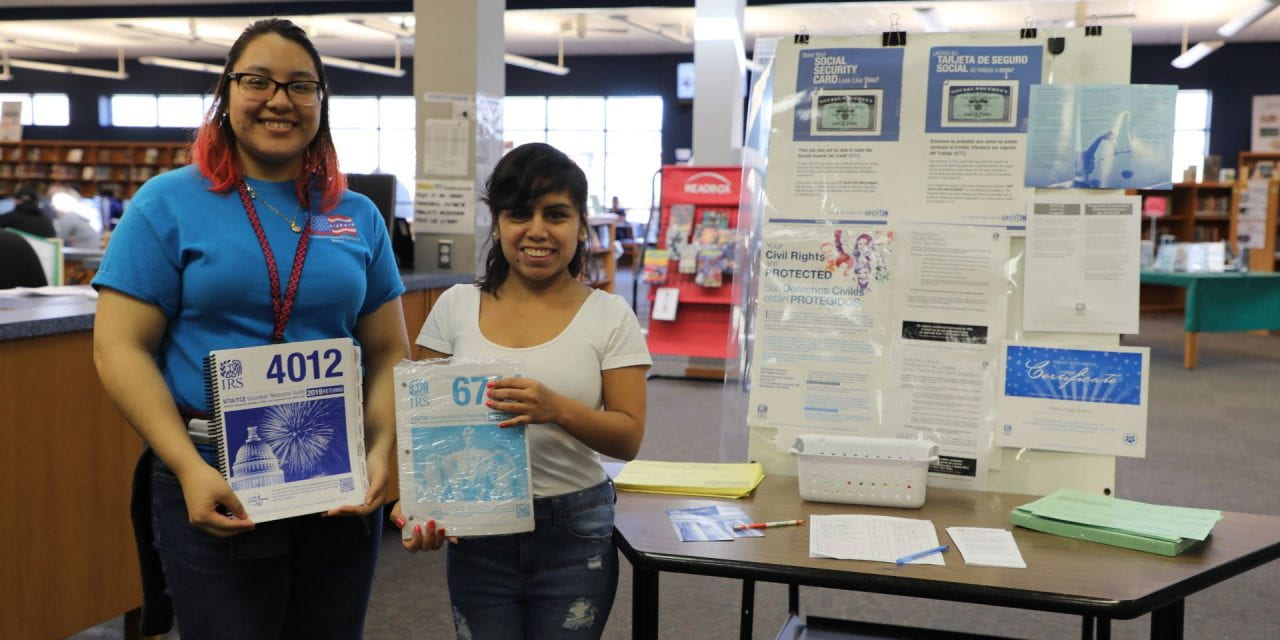

Tax season is upon us, and Nimitz High School students are here to help.

Student council members are trained and certified to offer free tax preparation services for the community through Volunteer Income Tax Assistance (VITA). Nimitz student tax preparers will offer free tax services every Saturday through April 11 from 9:30 AM to 2 PM at the Nimitz High School library (100 W. Oakdale, Irving 75060). This program is offered to anyone who makes a yearly income under $56,000.

“We ensure they receive the benefits of the Earned Income Tax Credit,” says Bernard Manale, the Nimitz teacher who oversees the program. “Single parents and those new to the workforce, who do not have the time to stay up with tax law changes benefit. In addition, many elderly taxpayers may feel at a disadvantage as tax laws change and technology becomes more sophisticated. Coming to the VITA site helps the elderly/retired taxpayers complete their return at no cost. It further ensures they are following the current laws and taking advantage of any new programs or tax law benefits.”

“We ensure they receive the benefits of the Earned Income Tax Credit,” says Bernard Manale, the Nimitz teacher who oversees the program. “Single parents and those new to the workforce, who do not have the time to stay up with tax law changes benefit. In addition, many elderly taxpayers may feel at a disadvantage as tax laws change and technology becomes more sophisticated. Coming to the VITA site helps the elderly/retired taxpayers complete their return at no cost. It further ensures they are following the current laws and taking advantage of any new programs or tax law benefits.”

Student tax preparers receive approximately 40 hours of training through the IRS website. As a minimum, they take courses in confidentiality and ethics, intake and interview techniques and advanced tax preparation. Prior to the onset of tax season, students spend three Saturdays reviewing tax law, practicing return preparation and role-playing scenarios before opening.

Each year, student tax preparers file between 500 and 600 returns a year for the last five or six tax seasons. Many are for repeat customers, including past students, employees of the district, and others from the Irving community.

“Most people are very grateful for this service and express their gratitude as the return is completed,” says Manale. “I have had, and have heard, many taxpayers report that in a prior year or years they paid several hundred dollars for the same service.”

To make the process as seamless as possible, they suggest the following tips:

- Before you begin, gather all documents from any income you received.

- Do a mental check of any expenses you have that could be considered for itemizing. As a minimum to itemize, you are looking for a cumulative amount of at least $13,000 or $26,000 if you are married/filing jointly, just to make the effort worthwhile.

- Ensure you have documents/receipts from any child care (or adult care) services you may have paid for in order for you to work.

- If you have been a victim of identity theft, you should have received a new PIN number from the IRS in January. This number is essential for your return to be processed.

- Double-check your bank account number to ensure it is accurate. If the number is off by a single digit and it is deposited into another’s account, it is next to impossible to recover that loss. The name or address is not verified through electronic filing – only the account number.